Key Takeaways

- Bloomberg raises XRP ETF approval prediction to 85% for 2025.

- Litecoin and Solana ETFs have a 90% probability of approval.

Share this text

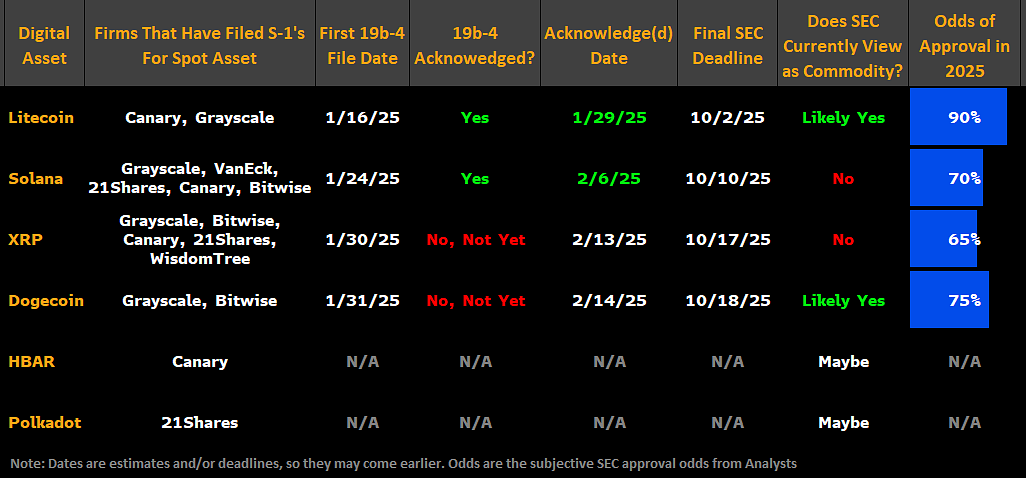

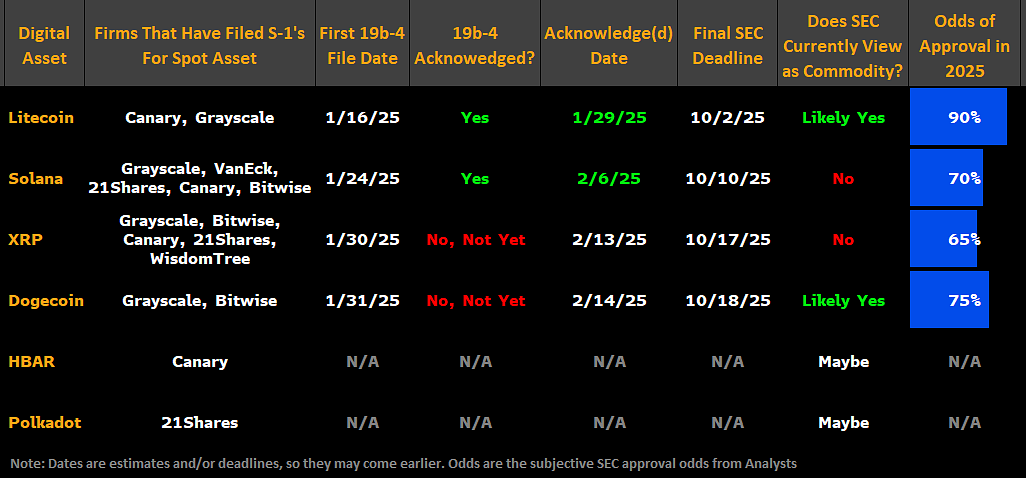

The probability of a spot XRP ETF launching in 2025 has elevated, in response to the most recent replace from Bloomberg Intelligence. Analysts now estimate an 85% probability {that a} spot XRP product will achieve approval from the SEC, up sharply from 65% of their February outlook.

ETF analysts Eric Balchunas and James Seyffart have additionally elevated approval odds for different digital asset-backed funds, with merchandise monitoring Litecoin and Solana main the pack.

Spot ETFs for Litecoin and Solana are given a 90% probability of approval by Bloomberg. Litecoin has particularly benefited from the CFTC’s classification of LTC as a commodity.

Solana’s approval likelihood has jumped from 70% to 90%, with the asset attracting a number of ETF filings and institutional curiosity pushed by its DeFi and NFT ecosystems.

Different belongings are additionally gaining momentum. Dogecoin and Hedera ETFs are assigned an 80% probability of approval.

The Cardano ETF, filed solely by Grayscale to date, carries an estimated 75% probability of approval.

Avalanche, one of many newest belongings to be filed for, is likewise at 75%, with a last SEC determination anticipated round December 12. Polkadot ETFs are monitoring on the identical 75% odds.

The SEC lately delayed decisions on a number of purposes, together with Franklin Templeton’s spot XRP and Solana ETFs, Grayscale’s HBAR ETF, Bitwise’s Dogecoin ETF, and Ethereum staking ETFs from Franklin and Constancy.

These funds be a part of a rising checklist of proposed crypto merchandise at present awaiting regulatory approval.

Most altcoin ETF selections are anticipated between Q3 and This fall of 2025. Whereas the SEC may reject purposes over market manipulation issues or inadequate investor protections, ETF specialists imagine denial is much less seemingly given futures market improvement, authorized progress, and bipartisan curiosity within the crypto market construction.

Share this text