- Ripple has not minted any new RLUSD tokens in over 41 days despite high market activity.

- The last RLUSD minting happened on April 25 as Ripple adopted a cautious supply strategy.

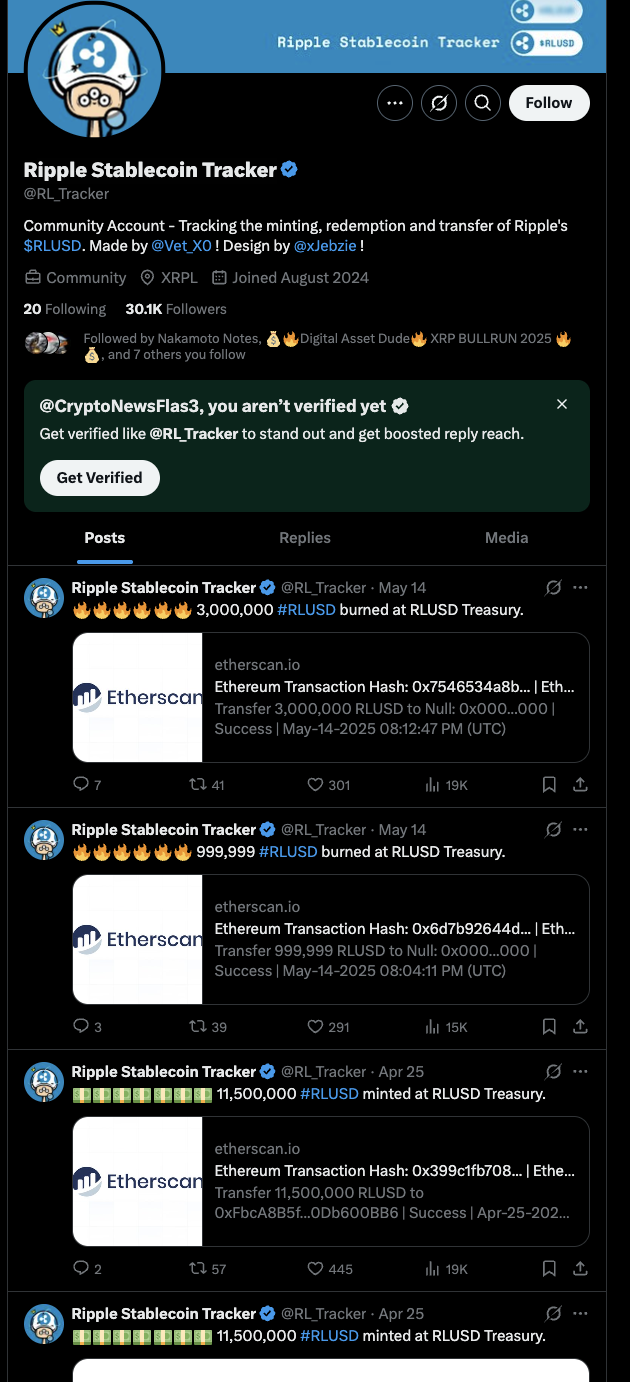

According to X posts thats tracks the minting of RLUSD, Ripple has not minted any new RLUSD tokens in over 41 days. The last issuance occurred on April 25, with 11.5 million RLUSD minted at the Treasury. This pause in stablecoin creation comes during a period of heightened market activity, including Bitcoin reaching an all-time high of $111,970.

Ripple will likely have held off on growing RLUSD supply despite greater trading volumes. The company had previously indicated caution with stablecoin issuance, planning to manage supply closely to ensure the coin stays stable and boosts demand. Ripple analysts suggest that the existing RLUSD supply may have already met institutional and on-chain demands, removing the need for new mints in the short term.

Moreover, Ripple’s measured supply strategy matches Ripple’s positioning against dominant issuance players such as Tether and Circle. Ripple maintains issuance for RLUSD, creating credibility around what it says is a fully-backed reserve model that it confirms by verifying independent audits.

Dubai Greenlights RLUSD for Regulated Use

Ripple has secured another key regulatory milestone from Dubai’s financial authority (DFSA), allowing it to use RLUSD in the Dubai International Financial Centre (DIFC). The approval enables DFSA-licensed firms such as banks, fintech startups, and payment service providers to incorporate RLUSD into their treasury operations and payment flows.

With DFSA approval, Ripple joins Circle as one of Dubai’s few regulated digital assets for use within its financial ecosystem and RLUSD as one of a small number of approved stablecoins. The stablecoin must adhere to extremely stringent transparency and reserve requirements to continue being eligible. An audited third-party audit shows RLUSD is backed 1:1 by liquid U.S. dollar assets held in custody, Ripple confirmed.

This is part of Ripple’s wider approach to push institutional utilization across compliant markets. Ripple focuses on financial centers like Dubai to make RLUSD more attractive to companies searching for safe, regulated digital currency solutions for cross-border settlements and asset tokenization.

Ripple’s efforts to roll out RLUSD in various sectors of the DIFC have received regulatory win. Zand Bank and Mamo are already partnered with local firms to speed up adoption. In addition, Ripple plans to incorporate RLUSD into Dubai’s public sector blockchain projects.

Some key initiatives entail collaboration with the Dubai Land Department to tokenize real estate ownership records on XRP Ledger. The pilot began in March and positions RLUSD as a transactional medium for future digital real estate markets.

This follows RLUSD’s recognition by the New York Department of Financial Services (NYDFS), propelling its global legitimacy. Ripple’s dual licensing in New York and Dubai is an indicator that it is sticking to its strategy to build compliant infrastructure for the use of digital assets.

XRP Eyes Breakout Amid Technical Signals

XRP, meanwhile, has been trading at $2.19, with analysts watching for a key breakout above $2.30. As per Crypto analyst EGRAG CRYPTO, the $2.07 support level is still intact. If the breakout is confirmed, it could indicate the beginning of a big upward move, leading XRP as high as $2.65 and $3.00.

XRP clearing $2.30 could confirm a double bottom pattern and signal the continuation of the Elliott wave, the third of which usually involves strong price movements.