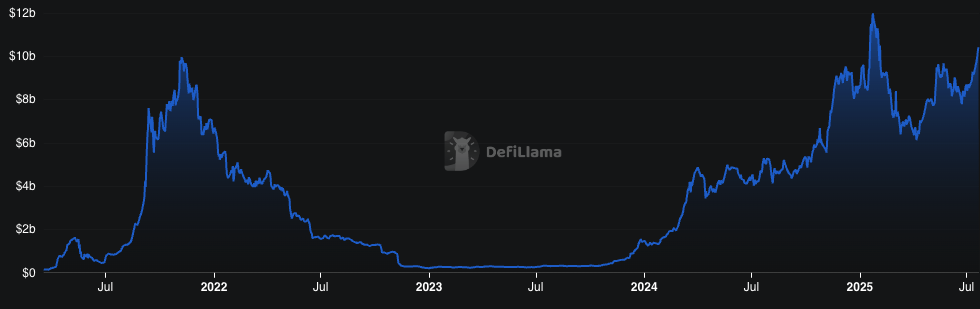

Solana’s restoration coincided with the same enhance in its DeFi TVL, which reached the best stage in six months.

The newest crypto bull run boosted each Solana’s (SOL) value and DeFi ecosystem. On Monday, July 21, Solana’s whole market cap as soon as once more crossed $100 billion, with SOL buying and selling at $194.62 per coin. With a market cap hovering beneath $105 billion, that is the best stage this metric has reached since Jan. 25 this yr.

On the similar time, the rise in Solana’s value additionally contributed to the rising worth of its whole ecosystem. Solana’s DeFi TVL has reached $10.453 billion, the best this metric has been since January, when SOL hit an all-time excessive.

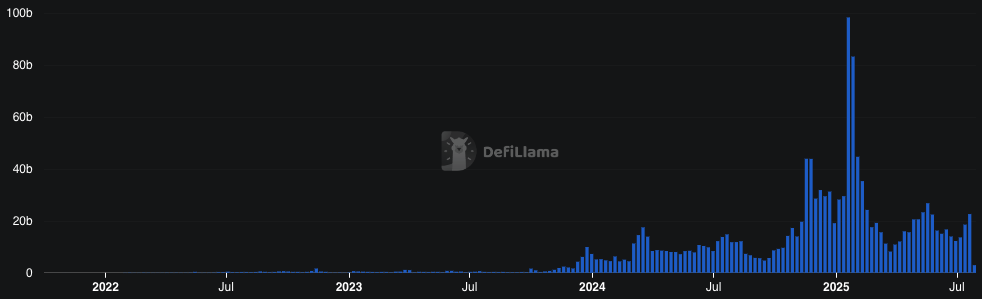

The expansion was additionally mirrored within the enhance in DEX exercise, though these figures didn’t strategy the January highs. Between July 14 and July 20, Solana DEXs processed $22.58 billion in quantity, up from $18.5 billion on the week prior.

Main amongst decentralized exchanges are Raydium, Orca, and Meteora, with weekly volumes of $8.4 billion, $5.9 billion, and $5.3 billion, respectively. Nonetheless, weekly DEX quantity stays removed from its peak in mid-January, the place it reached $98.28 billion.

Why Solana’s DeFi TVL rose

The most certainly cause for Solana’s DeFi TVL reaching a six-month excessive is the enhance from the Solana token value. It is because SOL tokens account for a major proportion of property held throughout the community’s DeFi protocols.

Solana’s DeFi TVL accounts for tokens, stablecoins, and memecoins deposited throughout numerous DeFi protocols throughout the Solana ecosystem. This consists of tokens in good contracts, lending swimming pools, or vaults.

Nonetheless, the DeFi TVL doesn’t embrace Solana tokens which might be staked with validators for securing the community. At the moment, this determine quantities to 355.4 million SOL, valued at $69.44 billion, or about 66% of all tokens in circulation. DeFi TVL additionally doesn’t embrace tokens held on centralized exchanges.