Michael Saylor bought another $100M worth of Bitcoin, and the move appears to have spooked markets, triggering a sell-off in MSTR stock.

Shares of MicroStrategy (MSTR), the Bitcoin-focused software firm now branded as “Strategy,” fell on Monday, September 22, even as the company revealed another large Bitcoin buy.

The firm disclosed it acquired 850 BTC between September 15 and 21 for about $99.7M at an average price of $117,344.

Strategy has acquired 850 BTC for ~$99.7 million at ~$117,344 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 9/21/2025, we hodl 639,835 $BTC acquired for ~$47.33 billion at ~$73,971 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/rG5pvryeYL

— Michael Saylor (@saylor) September 22, 2025

Why Is MSTR Stock Underperforming Bitcoin Despite New Buys?

The purchase lifted Strategy’s total stash to 639,835 BTC, bought for roughly $47.33Bn at an average of $73,971 per coin. At current prices, the holdings are worth about $72Bn.

To fund the deal, the company tapped its capital-raising programs for about $19M from its STRF preferred stock and more than $80M via its MSTR at-the-market stock sale. That activity adds new supply to the market and can drag on the share price through dilution.

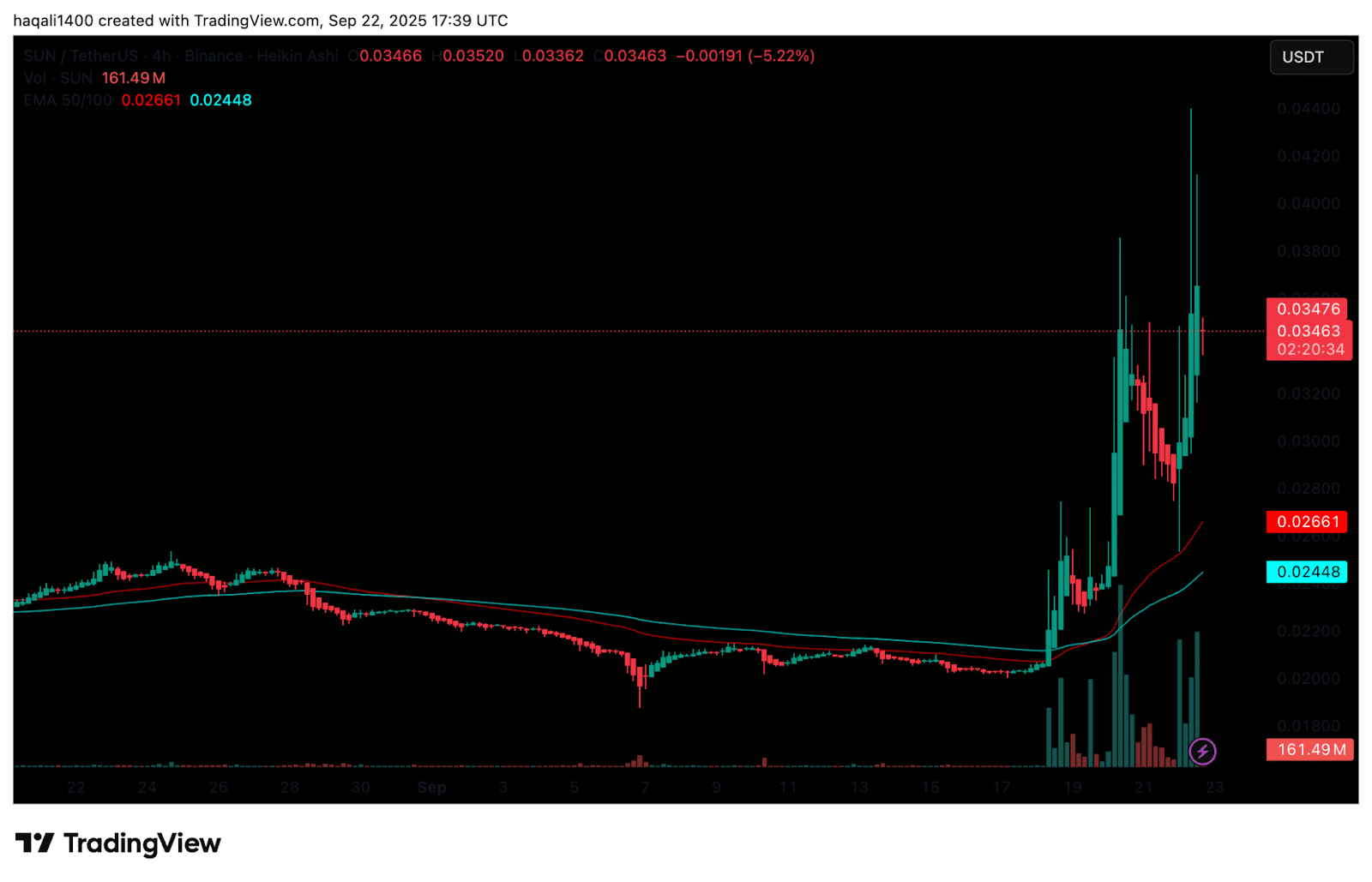

MicroStrategy’s stock is moving cautiously after weeks of uneven trading. The four-hour chart shows momentum has cooled since the mid-July peak, when the share price began sliding through August and fell below major moving averages.

(Source: MSTR Stock, TradingView)

Buyers tried to mount a recovery in early September, briefly lifting the stock back toward the $350 level.

That rebound stalled around the 50-period EMA at $344 and the 100-period EMA near $357. MSTR price pushed above both lines but quickly dropped to $336, highlighting that sellers remain active.

The failed breakout reinforces the broader bearish structure that has been in place since late July, with lower highs and lower lows continuing to shape the trend.

For now, support is around $330, while resistance sits in the tight $344-$357 band. Traders are watching to see if the stock can hold above $336 and press higher again.

A clean push above $357 would shift focus to $370, giving bulls room for recovery. If not, pressure could return, with the $320 zone back in sight.

Trading volume spiked during the drop, showing more vigorous selling activity.

Data from CoinGlass also points to stress in derivatives markets, with fresh waves of long liquidations in August and September.

The latest surge matched the sharp pullback in MSTR stock, underscoring the volatility surrounding Saylor’s Bitcoin-heavy bet.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Bitcoin Price Prediction: What Happens if Bitcoin Breaks Below $110K?

Bitcoin price (BTC USD) is trading near $112,400 after pulling back from last week’s highs, edging closer to the key $110,000 support level.

Analyst Crypto Tony posted on X that he expects a brief bounce before a dip into this support, followed by a more substantial rally toward the $120k-$126k range.

Plan of action on #Bitcoin. Small pump, dump then another big pump to come pic.twitter.com/OJSIqIPyH4

— Crypto Tony (@CryptoTony__) September 22, 2025

Since July, Bitcoin has been moving within a wide $110k-$122k band. Sellers have repeatedly rejected prices near $116k-$118k, while buyers have stepped in to defend lower levels.

The $110k mark remains pivotal. A sweep below could reset market positioning before any renewed move higher.

On the resistance side, hurdles sit around $114k-$116k, with more substantial barriers at $118k-$120k. A breakout above these zones would confirm the bullish case.

But if $110k fails to hold, Bitcoin risks sliding toward $108k-$105k.

Traders are focused on whether BTC can form higher lows after testing its base. A constructive rebound from support could set the stage for a push into the mid-$120k region in the weeks ahead.

Read More: Will TradFi Kill BTC USD Volatility? Lessons From Forex?

The post TradFi Dump MSTR Stock on Saylor’s Head After 100M Bid appeared first on 99Bitcoins.