- EasyA co-founders claim XRP tokenization will make the world’s wealthiest investors richer.

- Ripple expands into DeFi by developing tokenization RWA initiatives to make XRP a bridge currency for global liquidity.

Phil and Dom Kwok, co-founders of EasyA, argued that asset tokenization could transform access to global wealth through XRP. Phil, who is also a crypto analyst, explained that asset tokenization will give every billionaire access to instant liquidity.

Rich Investors to Unlock More Wealth with XRP Tokenization

Referencing a Financial Times report, the analyst highlighted a paradox in wealth management. “The trick to being a multibillionaire is having zero liquidity,” Phil Kwok wrote in an X post.

Phil sees this as a positive signal for crypto because tokenization offers a solution to real-world problems. He explained that tokenization involves converting real-world assets (RWAs) into digital tokens on a blockchain, making them divisible, tradable, and always accessible.

This addresses the liquidity issue by allowing billionaires to unlock value from their holdings without selling them outright.

Phil extends the benefit of tokenization beyond billionaires to the general public. Notably, tokenization democratizes access to high-value assets through fractional ownership.

The analyst explained that this inclusivity is a game-changer, as it lowers the entry barrier. It also taps into retail investor demand, a market far larger than the ultra-rich segment.

Phil added that crypto will no longer play second fiddle to traditional finance (TradFi), which relies on slow, centralized systems with high costs and limited trading hours.

To Phil, the advantages of tokenizing assets on blockchains position crypto as a superior alternative, potentially overtaking TradFi in efficiency and adoption.

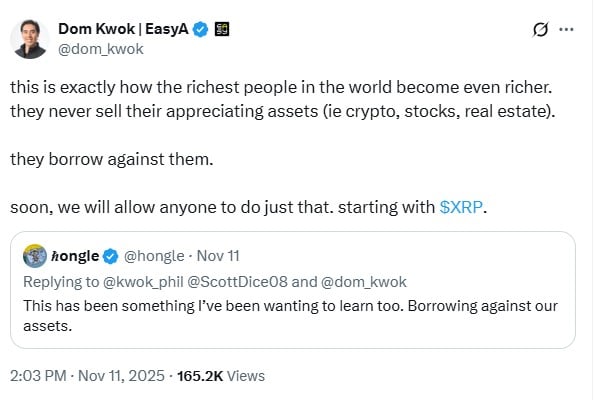

Expanding on Phil’s statements, Dom Kwok focused on how billionaires manage their wealth. Dom stated that the world’s wealthiest individuals grow richer by never selling their appreciating assets, such as stocks or real estate.

Dom revealed that EasyA plans to make this model available to everyone, beginning with XRP, the Ripple-backed coin.

XRP Expands Its Role in DeFi

The comments from Phil align with growing interest in crypto-backed loans to allow people to access cash without selling their crypto. Under this system, users can lock up coins like XRP as collateral.

They can also borrow stablecoins or fiat currency, and repay later, retaining any gains if the price of the coin rises. This approach, however, allows billionaires to defer taxes. Still, some community members have raised concerns about market risk and liquidation.

Dom, however, suggested that future borrowing systems should allow users to customize their margin of safety. As a result, conservative investors can borrow less and reduce their liquidation risk.

The comments from the EasyA founders align with a broader XRP movement into decentralized finance (DeFi) and tokenization infrastructure.

Ripple continues to develop tokenization RWA initiatives, aiming to make XRP a bridge currency for global liquidity. In a recent study we reported on, Ripple CEO Brad Garlinghouse said XRP positions as a strong candidate for RWA tokenization.

Meanwhile, Ripple predicted in an April report that the tokenization market could reach $18.9 trillion by 2033. To further expand its tokenization push, Ripple is planning to establish a National Trust bank.