Approvals. Government nod. Crypto providers, it seems, can’t escape this. Regulators all over the world want blockchain companies, regardless of their offerings, to register and adhere to existing laws. By compliance, officials say crypto moves from the “wild”, unlocking institutional involvement.

This is good and bad for crypto purists. However, in 2026, looking at recent trends, regulations has its benefits. After years of back and forth with the US Securities and Exchange Commission (SEC), Ripple, the blockchain company and the firm closely associated with XRP, one of the best cryptos to buy, is towing the line. Today, on January 14, Ripple said it had secured early approval for a Electronic Money Institution (EMI) license in Luxembourg, giving the company a regulatory foothold inside the EU. The approval was granted by the country’s financial regulator, the Commission de Surveillance du Secteur Financier (CSSF).

Great meeting with @Ripple, as they advance toward securing their license to operate in Luxembourg.

We discussed their ambitions in Europe and Luxembourg, and I reaffirmed our commitment to digital innovation. pic.twitter.com/JLbEezTGPE— Gilles Roth (@RothGilles) October 9, 2025

Like most tokens, including some of the best cryptos to buy, XRP crypto edged higher before stabilizing today. The XRP price is steady above $2, and technically bullish, looking at price action from a top-down perspective.

DISCOVER: Top Solana Meme Coins to Buy in 2026

What did Ripple Actually Get Approval For From Europe?

That the XRP price is firm means traders are focusing on regulation progress, not hype. Looking at this development from Ripple’s position, it is clear that they are moving fast, expanding as Europe pushes MiCA rules that reward firms willing to play by clear, strict rules. MiCA is the first comprehensive legal framework for crypto-assets in the EU. There are four laws that MiCA makes mandatory for crypto firms. One of them demands that crypto service providers like Ripple must register.

The approval is not final yet. But it signals that European regulators see Ripple as a serious, compliant payments company, not a legal gamble. From what we know, Luxembourg’s financial watchdog gave Ripple a preliminary nod for an Electronic Money Institution (EMI) license. Think of an EMI like a digital bank passport. It lets a company move money, issue e‑money, and run payment rails under supervision. For everyday users, this matters because EMI licenses unlock legal access across the EU. Once finalized, Ripple can “passport” services into other countries without reapplying each time. Thus far, Ripple is already registered in Ireland as a Virtual Asset Service Provider (VASP).

BREAKING: Ripple has been added to the Bank Of Ireland’s Virtual Asset Service Providers List

$XRP

What will this do?

Registration will allow the enterprise blockchain and crypto solutions firm to provide certain digital assets services within Ireland! pic.twitter.com/SBk0E47VfQ

— MASON VERSLUIS (@MasonVersluis) December 20, 2023

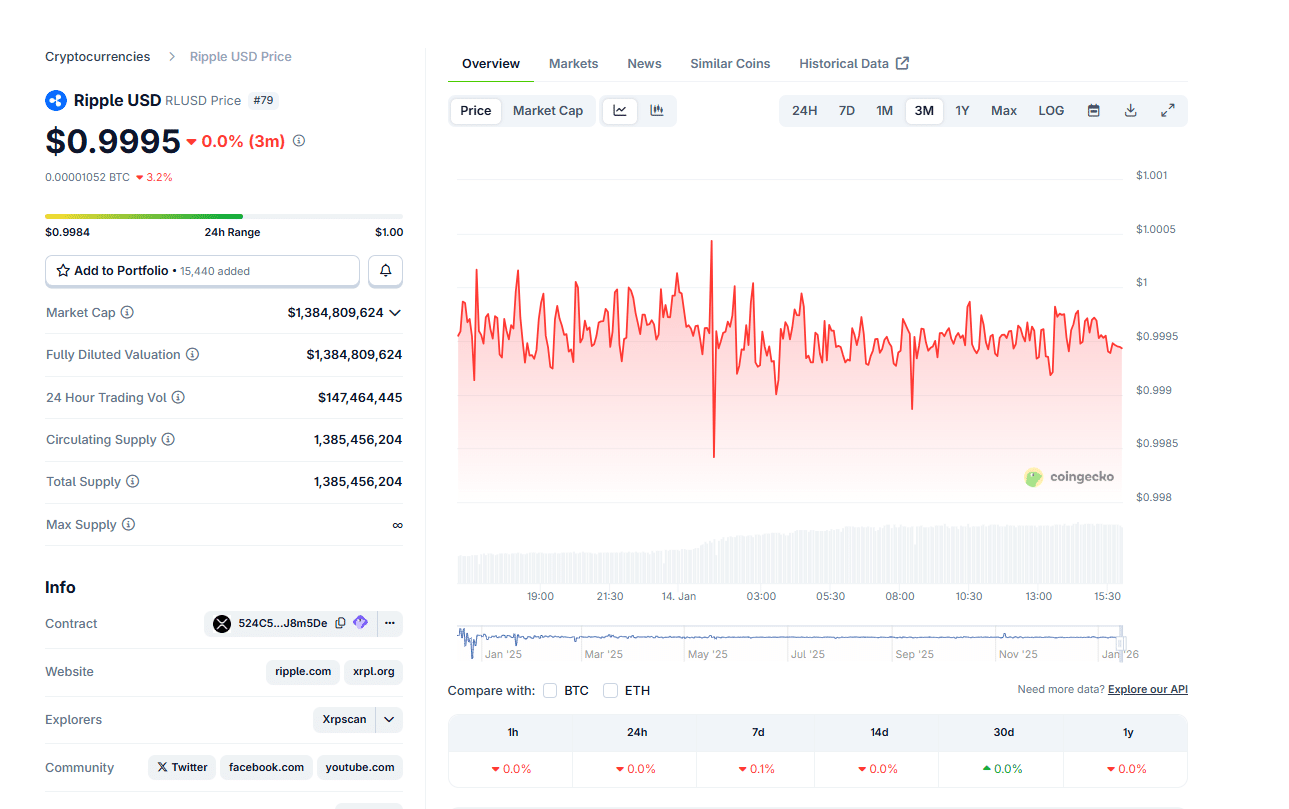

Ripple has prepared for this since 2025 by setting up Ripple Payments Europe in Luxembourg. The country already hosts major crypto firms because its regulator acts as a central MiCA authority. Besides the unlocking of legal access across the EU, CSSF will permit Ripple to offer regulated payment services involving stablecoins and other digital assets. Ripple has already joined the stablecoin fray through RLUSD. Presently, RLUSD is among the top 20 stablecoins by market cap with over $1.3Bn in circulation.

(Source: Coingecko)

DISCOVER: Top Solana Meme Coins to Buy in 2026

Why Europe Matters Now

The US might be the hub of crypto innovation and activity, especially after Donald Trump took charge, but the EU now offers something special. With MiCA, Europe clearly tells crypto companies exactly how to operate, what licenses they need, and how stablecoins must behave.

This could explain why Ripple is acting fast. The CSSF approval is days after receiving UK regulatory approval, building a Europe‑first playbook. The more Ripple secures licenses in different countries, the fewer legal uncertainties there are. In turn, this strategy helps Ripple sell its payment tools to banks and fintechs. For XRP holders, regulation equals usability. A token that banks cannot touch has limited value. A token wired into regulated payment flows becomes more relevant.

The future of regulated digital assets payments in the UK has arrived!

Ripple has officially secured approval of both an EMI license and Cryptoasset Registration from the UK's FCA.

Who better to explain what it means than our UK and Europe Managing Director @CraddockCJ.… pic.twitter.com/q2xyeJQXEF

— Ripple (@Ripple) January 9, 2026

Evidently, Ripple plans to expand its services in Europe. RLUSD will be central, and since the more RLUSD finds adoption, the higher the demand for XRP, traders will be closely watching whether Ripple succeeds in Europe. Under an EMI license in Luxembourg, Ripple can legally plug stablecoins into real payment systems. That opens doors with merchants, payment processors, and cross‑border settlement partners.

Ripple is also pursuing full MiCA authorization next. If it gets to operate as a fully regulated crypto asset service provider (CASP) in Europe, they will have an opportunity to offer even more services. As Ripple’s history shows, regulatory wins support price in the long‑term.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Ripple Gets Early Europe License Nod: Why XRP Crypto Holders Are Watching appeared first on 99Bitcoins.