BTC bulls helped stage a quick recovery on August 7, 2025, reclaiming the 117k level after a brief downward stint below the Bollinger Band support, in what analysts are calling a textbook “head fake” reversal, reigniting bullish sentiments as the best crypto to buy now.

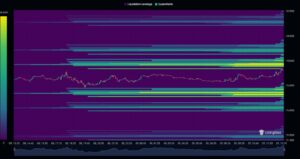

Now that bullish sentiments have reignited, traders are eyeing the 119k mark as the next major resistance zone. Moreover, according to the BTC heatmap data, liquidity clusters between $117.5k and 118k suggest that there might be a potential grind higher as traders continue to liquidate short positions.

Further to this, the daily CME futures gap has been filled, establishing a new support near $114k. In the background, there is a divergence forming between spot price action and ETF flows. Bollinger has flagged the setup as a possible trap for overzealous bears.

According to CoinGlass’s heatmap data, the BTC is encountering mounting resistance in the growing liquidation clusters between 117.5k and 118k. On the flipside, downside bids are accumulating around 114k, a level reinforced by the completion of the CME futures gap.

This level has historically served as a key point of convergence for spot prices, enhancing its credibility as a support base.

$BTC liquidation map shows major long cluster at ~116000 (left) and short cluster at ~118000 (right). These act as price magnets, potential volatility drivers. Config: optical_opti. pic.twitter.com/iJDczuolzG

— TheKingfisher (@kingfisher_btc) August 9, 2025

Analysts suggest that if the BTC can push past the 119k mark, $120k becomes the next big target both psychologically and technically.

Explore: Top Solana Meme Coins to Buy in August 2025

Ethereum Eyes $4500! Is It The Best Crypto To Buy Now?

Over the last 24 hours, ETH saw $229.49 million in futures liquidation, with CoinGlass’s data showing $22.24 million wiped away from longs and $207.25 million from shorts. ETH bounced off support near $3,470 last week and has since then surged 15% reclaiming the $4000 mark for the first time since December 2024.

As of this moment, ETH is facing resistance at the $4100 level, marked by historical selling pressure and a descending trendline that traces back to its November 2021 all-time high.

A breakout above the $4100 mark could result in another bullish run and could potentially see ETH surge towards the $4500 mark, a key resistance zone before retesting its all-time high of $4,868.

Meanwhile, it must defend its $3470 support to preserve this bullish momentum. A weekly close below this level could trigger a drop towards $3220, and if that fails, the $3000 psychological support zone might come into play.

Momentum indicators, such as the RSI indicator, are flashing red as the ETH nears the overbought territory, while the Stochastic Oscillator has remained overbought since June. While signals currently indicate a bullish momentum, the possibility of a short-term cooldown must not be ruled out.

$ETH: Looks really good here, it reached the highest price since December 2021. This is a breakout through a multi-year resistance. Could jump to 5k and then re-test 4k as support. https://t.co/KdV98aYjvM pic.twitter.com/1qDPl7YaID

— Christian Ott (@ChrisOtt) August 9, 2025

On a brighter note, ETH has gained more than 180% since hitting its recent low of $1385 in April and has rallied by more than 60% over the past month. A strong buying pressure from corporate entities pivoting towards ETH treasury has fuelled this recent performance.

Moreover, it received a regulatory boost from the SEC (Securities and Exchange Commission) on 5 August 2025 after the regulatory body clarified that liquid staking of crypto assets doesn’t breach securities law.

Explore: 10+ Crypto Tokens That Can Hit 1000x in 2025

Meme Coin Bitcoin Hyper’s Presale Explodes Past $7.7M

Hyper Bitcoin has taken the meme coin industry by storm, with a whale recently investing $96k in it. Hyper, a new meme coin and a Bitcoin layer 2 project, is built using the Solana Virtual Machine (SVM).

It aims to bring gaming, DeFi and real-world asset tokenisation onto Bitcoin’s ecosystem by offering faster transaction time and lower fees, all while maintaining a Bitcoin-grade security.

The meme coin has already raised over $7.7 million in its presale, and while there is no official launch date yet, there is speculation of a Q3 debut.

Hyper uses a bridge mechanism to lock BTC and issue a wrapped token usable across dApps, and also offers a 320% APY staking option for early participants.

With Bitcoin gaining momentum, Hyperis is gaining interest among smart money investors as a potential Q4 breakout play!

VivoPower’s $100M Ripple Buy Plan Boosts Share Price Over 32%

Shares of VivoPower, the Nasdaq-listed solar power company, shot up by 32.12% to $5.10 on 8 August 2025 after it announced its decision to acquire $100 million worth of privately held Ripple Labs stock to expand its XRP-centric digital treasury strategy.

According to its press release dated 8 August 2025, VivoPower will buy these shares directly from existing shareholders based on its two-month-long due diligence, provided, Ripple’s executive management approves of this decision.

BREAKING: A $100M bet could put XRP at the center of corporate finance.

And it’s not from a fintech or crypto giant — it’s from a global energy solutions company.

Here’s why VivoPower’s Ripple gamble has the market buzzing

:

1/ VivoPower International just announced plans to… pic.twitter.com/S1MRg0IoGq

— Ripple Van Winkle | Crypto Researcher

(@RipBullWinkle) August 9, 2025

For this to work, VivoPower will partner with BitGo for secure asset custody and Pasdaz Private Market, Ripple’s preferred platform for private share transactions.

In its press release, the company suggests that for every 10 million Ripple shares, VivoPower shareholders could expect a value accretion of $5.15 per share, depending on market volatility.

WLF Considering A $1.5B Public Vehicle For WLFI Token Holdings

President Trump backed World Liberty Financial is planning to use a $1.5 billion publicly traded shell company as a treasury vehicle to hold its WLFI governance tokens.

According to a report published by Bloomberg on 9 August 2025, major crypto and tech investors have been approached, while the structure of the deal is still being finalised.

This move mirrors the strategy implemented by Michael Saylor’s MicroStrategy, now rebranded Strategy, which in recent times has inspired a wave of crypto treasury firms.

Big investors are being sounded out on a plan for World Liberty Financial, the Trump family-backed venture, to set up a public company that would hold its WLFI tokens, joining the boom in digital-asset treasury firms https://t.co/M31uD7CbW0

— Bloomberg (@business) August 9, 2025

The venture so far has raised $550 million through public token sales with high-profile investors such as Justin Sun and Web3Port backing the project. Trump himself disclosed earning over $57.4 million from WLFI token sales and holds over 15 million tokens.

Ondo’s Technical Indicators Turn Bullish, Price Surges By 2.2%

While the news cycle has been relatively quiet, Ondo’s 2.2% daily gain reflects a growing technical strength and alignment with the broader market sentiment.

Institutional interests in real-world asset tokenisation continue to support protocols like Ondo Finance within the DeFi ecosystem.

Ondo is currently trading at $1.04 after briefly touching the $1.05 mark.

The bullish sentiment appears to be largely based on technicalities, with traders reacting to Ondo’s position above key moving averages and its approach towards resistance zones.

$ONDO inverse Head & Shoulders almost complete.

Ondo Global Markets is about to change the game. pic.twitter.com/MlgQGbqcUT

— Rendoshi Ondomoto

(@Rendoshi1) August 9, 2025

Its floating support sits at $0.84, with a stronger support at $0.62 level. On the upside, the resistance is concentrated around $1.17, marking a 12.5% potential gain from current levels.

The pivot point of $1.03 is just below the current price.

Explore: 9+ Best High-Risk, High-Reward Crypto to Buy in August 2025

The post BTC Breaks Above 117k, Eyes 119k Next, ETH Breaks $4000 Mark: Best Crypto To Buy Now appeared first on 99Bitcoins.