The recent Fed (Federal Reserve) rate cut and news about the US-China trade realignment has created some favorable tail wind for riskier assets such as BTC, however, contrary to the collective hopes of many, the market has not yet found its footing.

For now

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.25%

Bitcoin

BTC

Price

$110,887.02

0.25% /24h

Volume in 24h

$34.49B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

is consolidating and has stabilized above $110,000, posting a 0.98% gain the in last 7 days and 0.50% in the last 24 hours.

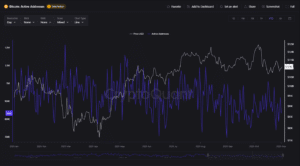

BTC has been moving sideways between the 100-dam SMA (Simple Moving Average) $114,194 and the 200-day SMA acting as support at $109,763. The lower end near $109,000 has consistently attracted strong buying interest.

(Source: TradingView)

The upper end near $114,000 is where most of the profit taking is happening. This back and forth shows that the market is currently balanced, with buyer and sellers evenly matched.

For BTC to regain its upward momentum, it needs to decisively breach its 100-day MA or hold on to its 200-day MA for support.

If BTC manages to close above the $114k level on the daily chart, it could break out and head towards $120k or even $122k. However, if it slides below $108k, it might fall further to the next support zone where buyers are likely to step in, around the 102k or the 104k level.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

BTC Price News: 4 Hour Chart Analysis Shows BTC Consolidating Before A Breakout

On the 4-hour chart, BTC price keeps bouncing off the $108k -$109k level, which is acting as a floor where buyers step in. Each time it bounces off of this level, its price makes a higher low, showing strength.

However, it hasn’t been able to breach the $115k level, which is acting as seller stronghold.

For now, the price swings are getting smaller and the tension is building before its possible breakout. It BTC climbs above $116k, it could generate further momentum to tackle $115-$116k levels.

$BTC price is approaching the $111,075 resistance level. A sustained break above this level would suggest that at least wave-(C) is unfolding to the upside. pic.twitter.com/VCGaMeZt5M

— Man of Bitcoin (@Manofbitcoin) November 2, 2025

However, if it drops below $108k, it might test the next support zone at $102k.

Either way, until one of these levels give, BTC price action will continue to move back and forth between this range before its breakout.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

BTC Network Activity Slows, But $108k Support Holds Firm

In another BTC news, even though BTC price is up and has stabilized above $110k, the number of active addresses have slowly dropped. This usually means that the market is cooling off a bit.

(Source: CryptoQuant)

Speculation wise, it looks like traders are taking profits, or are waiting for the next move. Still, the current market activity is higher than that it was during the 2024 accumulation phase, suggesting that the market isn’t in panic mode as of yet.

In fact, similar dips in address activity near price support levels have come just before a big buying phase and trend reversals, like what happened in late 20223 or mid 2024.

If the number of active addresses start to stabilize while BTC price holds steady between $108 -$110k, it could be a sign that investors are quietly accumulating again.

EXPLORE: Top 20 Crypto to Buy in 2025

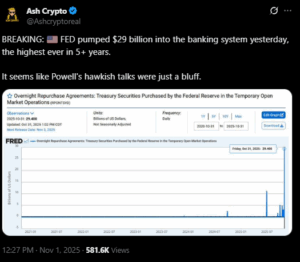

BTC Bounces To Above $110k After Fed Liquidity Boost

The Fed injected $29 billion in the the US banking system and the crypto market reacted instantly. BTC, ETH and the broader crypto market rebounded by 2% after several days of losses to $3.71 trillion.

The FED’s cash boost was not meant to flood the economy with money. Instead it was a temporary fix to ease pressure from the banking system. Analyst Ash Crypto summed up this move as Fed Chair Jerome Powell is keeping up appearance publicly but making sure that the financial system does not freeze.

The move highlights a balancing act by the Fed where it uses strong words to maintain credibility while acting as dovish to keeps the banks stable.

Moreover, the $29 billion injection also lifted the market sentiment. The Fear and Greed Index, ticked up from 29 to 33, showing a slight shift away from fear.

EXPLORE: 9+ Best Memecoin to Buy in 2025

The post [LIVE] BTC NEWS: BTC Stabilizes Above $110k, What’ll It Take For It To Retest $115k? appeared first on 99Bitcoins.