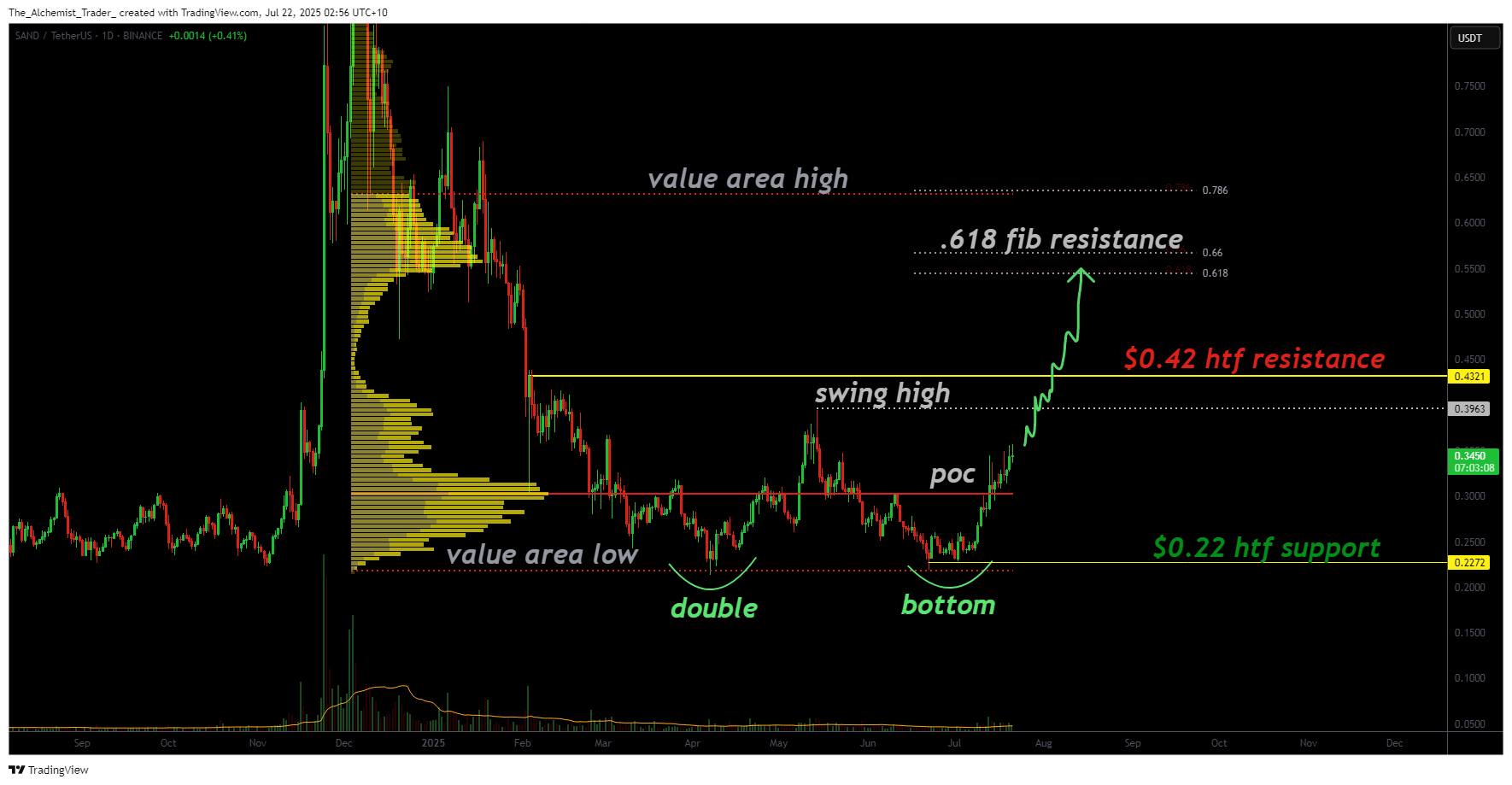

Sandbox is trading at a critical inflection point, showing signs of a potential trend reversal. If key resistance levels break, the price could accelerate toward the $0.60 region, driven by a classic double bottom formation.

The Sandbox (SAND) is currently forming a textbook double bottom formation at the lower end of its long-term trading range. This bullish reversal pattern has the potential to mark the end of the previous downtrend and begin a new uptrend characterized by higher highs and higher lows.

Price has reclaimed the point of control, which is the region with the highest traded volume, and is now testing the next major resistance level at $0.42. A clean breakout and hold above this level could trigger an accelerated move toward the 0.618 Fibonacci retracement level, currently situated around $0.60. This would signal a significant shift in market structure and open the door to further upside.

Key technical points:

- Double Bottom Formation: Classic bullish reversal pattern forming near high time frame support at $0.22

- Reclaim of Point of Control: Strong volume node now acting as support after multiple candle closes above

- Next Resistance at $0.42: Break and hold above this level could lead to a fast move toward $0.60

Sandbox’s price action has shifted into a more bullish tone after reclaiming the point of control, which sits in the middle of the recent trading range. This level, representing the highest concentration of trading volume, now acts as strong support. Multiple candle closes above the point of control suggest growing buyer conviction and potential momentum for further gains.

The structure forming at current levels resembles a double bottom, a bullish chart pattern often seen at the end of a downtrend. If this formation plays out fully, it will invalidate the previous bearish structure and reinforce a shift into bullish continuation. However, the breakout confirmation will come once Sandbox convincingly reclaims the $0.42 resistance level.

Above $0.42, the price faces little immediate resistance. A move to the $0.60 region, where the 0.618 Fibonacci level aligns with the value area high, could follow quickly if momentum holds. That area is expected to act as the next significant resistance if buyers maintain control.

Volume remains a crucial confirming factor. Sustained or increasing buy-side volume is necessary to validate this structure and ensure the momentum carries through resistance levels. Without this, the move risks fading or stalling at the next barrier.

What to expect

As long as Sandbox holds above the point of control and continues to print higher lows, the bullish double bottom formation remains valid. A reclaim of $0.42 resistance would open the door to a swift expansion toward $0.60, supported by strong market structure and minimal resistance in that region.