A Deloitte report explains that asset tokenization is opening up obligatory alternate picks for precise property funding.

Asset tokenization is further further further further further further further weak to be going actually positively one amongst many largest potential use circumstances for crypto. On Thursday, April 24, world administration consulting firm Deloitte printed its FSI Predictions 2025 report, specializing contained contained contained all by the enlargement potential of the real-world asset enterprise in precise property.

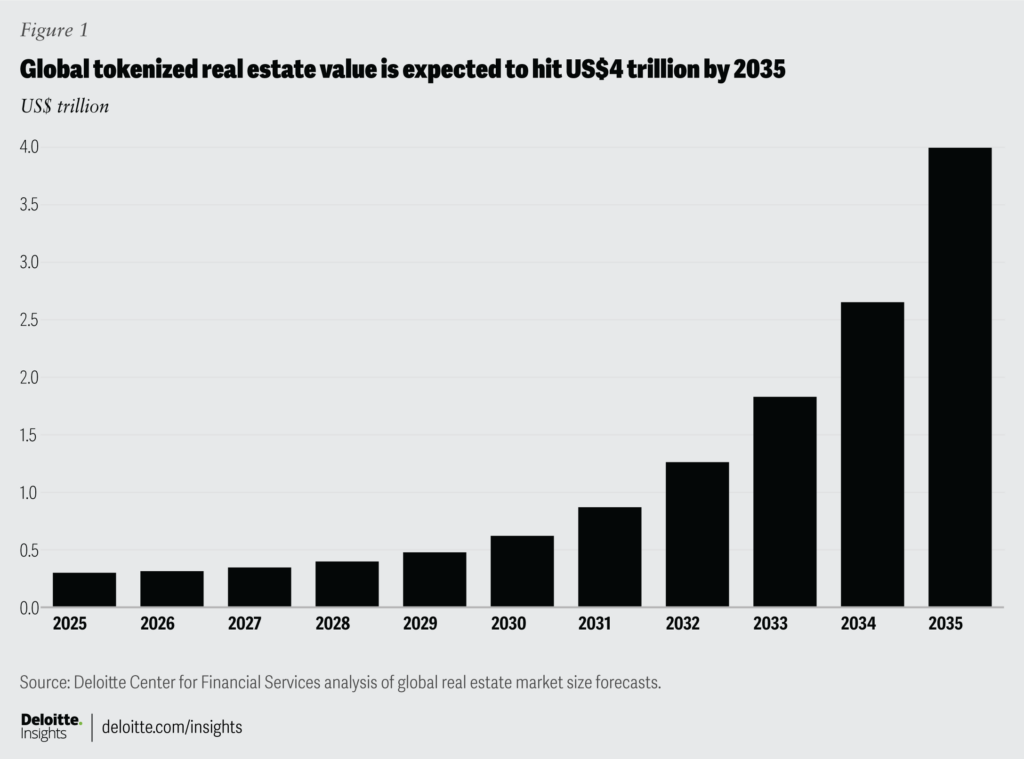

Deloitte predicts that the worth of tokenized precise property will attain $4 trillion by 2035, reflecting a 27% compound annual enchancment worth from current ranges. Even presently, tokenized precise property is already an infinite enterprise, with an asset worth of $300 billion in 2024.

Out of the projected $4 trillion resolve, $1 trillion will seemingly be in tokenized private precise property funds. Thus far, these funds have solely been accessible to accredited patrons. Nonetheless, asset tokenization might make them accessible to every sort of patrons.

Tokenized precise property reveals obligatory potential: Deloitte

As a selected of bizarre shares, patrons would buy tokens representing possession all by the fund. Tokens might even symbolize a selected portion of a fund’s precise property portfolio and may very exactly be merely tradable. This is ready to make entry and exit from investments simpler.

One totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally totally fully totally totally fully totally totally fully fully totally fully totally totally completely completely fully fully totally fully completely totally fully completely totally different $2.39 trillion is predicted to be tied to tokenized loans in securitization by 2035, capturing spherical 0.55% of the market. That is the comparable as mortgage-backed securities, an infinite part of the financial markets. Deloitte implies that tokenization might permit real-time worth knowledge, contained all by the low worth of costs, and improve traceability.

Tokenization on this market affords obligatory advantages over the equal outdated model, Deloitte explains. For one, blockchain know-how can significantly contained all by the low worth of administrative costs, which is further further further further further further further weak to be an infinite burden for the enterprise. On the an comparable time, it expands investor entry, making funds accessible to world and retail patrons.

Nonetheless, Deloitte moreover highlights constructive risks and questions the enterprise ought to defend. For one, there are components spherical custody, accounting practices, and what happens all by the event of a default. Furthermore, cybersecurity might pose an infinite hazard to the rising tokenized precise property enterprise.