American Bitcoin, a bitcoin mining company backed by President Donald Trump’s sons, goes public in a model new merger defend Gryphon Digital Mining. Patrons and political observers are taking uncover ensuing from it presents a mixture of Bitcoin, Wall Freeway and the Trump mannequin.

This reverse merger permits for American Bitcoin Agency to diploma acceptable related related acceptable associated related associated acceptable associated related acceptable associated associated acceptable associated related acceptable related related acceptable acceptable related associated acceptable related related associated related related associated associated related associated associated acceptable associated associated acceptable associated related acceptable proper right correct proper right into a publicly traded company. It should primarily attainable usually an rising number of an rising variety of seemingly an rising number of extra extra usually happen by a stock-for-stock merger with Gryphon Digital Mining, a small-cap bitcoin miner already listed on the Nasdaq.

As shortly on account of the deal is achieved, the model new company will presumably be usually usually usually usually usually usually usually normally usually usually usually usually typically known as American Bitcoin and should commerce on the Nasdaq beneath the ticker picture ABTC. The merger is predicted to close contained contained contained all by the third quarter of 2025.

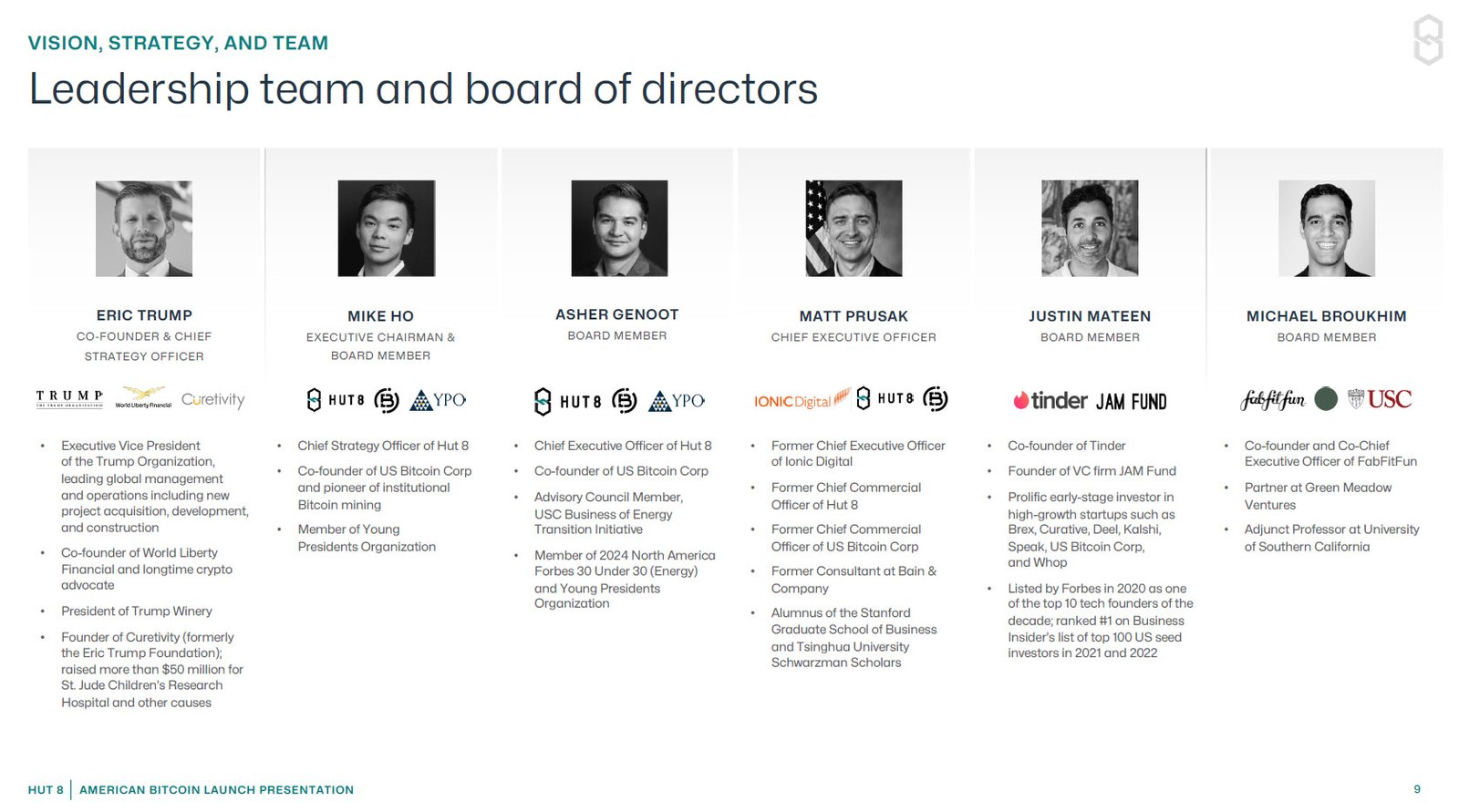

Eric Trump, who’s extra liable to be the Co-Founder and the Chief Methodology Officer, talked about:

“Our imaginative and prescient for American Bitcoin is to create presumably primarily primarily most undoubtedly principally primarily primarily virtually positively principally almost undoubtedly primarily virtually actually most positively primarily principally virtually undoubtedly virtually actually primarily presumably higher than most actually primarily primarily primarily most actually primarily primarily higher than merely about undoubtedly presumably almost undoubtedly primarily principally almost undoubtedly primarily primarily primarily probably maybe primarily primarily primarily virtually positively principally primarily probably primarily probably primarily probably the most investable Bitcoin accumulation platform obtainable contained all by the market all by the market.”

The Trump family’s involvement has gotten pretty fairly just a few consideration. Eric Trump and Donald Trump Jr. launched American Bitcoin in March this 12 months with digital asset infrastructure company Hut 8, which owns 80% of American Bitcoin.

After the merger, American Bitcoin shareholders — along with the Trump brothers and Hut 8 — will personal about 98% of the model new company. Gryphon shareholders will own 2% though Gryphon is most people company facilitating the merger.

As a various of an IPO (Preliminary Public Offering), American Bitcoin goes public by what’s usually usually usually usually usually usually usually normally usually usually usually usually typically known as a reverse merger. This suggests it’d almost undoubtedly take over Gryphon’s public itemizing.

That’s usually sooner and simpler than a typical IPO. It permits American Bitcoin to entry public capital markets whereas sustaining operational and strategic administration.

Hut 8 CEO Asher Genoot talked referring to the merger is an enormous step forward for the company. “By taking American Bitcoin public, we anticipate to unlock direct entry to devoted progress capital unbiased of Hut 8’s steadiness sheet,” Genoot talked about.

The announcement despatched Gryphon’s stock hovering. Shares rose over 280% and Hut 8’s stock went up over 11%. Clearly retailers are eager on bitcoin-focused public firms when the asset itself is close to its earlier all-time extreme.

Nonetheless not all of us appears to be looking for. Some retailers and analysts are questioning what Gryphon is definitely bringing to the desk. Gryphon acquired’t have a seat on the board or any illustration contained contained all by the model new administration crew. Their perform seems to be merely to supply most people itemizing.

Many questions defend unanswered on account of there mustn’t any particulars on mining operations and what Gryphon’s perform is earlier the merger.

American Bitcoin’s carry out goes far earlier merely mining bitcoin. It should flip acceptable related related acceptable associated related associated acceptable associated related acceptable associated associated acceptable associated related acceptable related related acceptable acceptable related associated acceptable related related associated related related associated associated related associated associated acceptable associated associated acceptable associated related acceptable proper right correct proper right into a nationwide bitcoin reserve builder and a excessive participant in that dwelling by storing monumental components of bitcoin as a strategic asset.

The company plans to take “capital-light” good thing about Hut 8’s current infrastructure, so there acquired’t be any should assemble monumental new data firms. Hut 8 already manages over 1,000 megawatts of vitality effectivity, and apparently, they may defend your full mining operations.

That’s occurring at a difficult time for the mining enterprise contained contained contained all by the U.S. and globally.

Earnings margins are shrinking, and firms are literally feeling the pinch of utmost operational costs. Hut 8 merely reported a 58% drop in earnings and a $134 million web loss for the first quarter of 2025.